Open topic with navigation

Reporting for charities

Introduction

For non-profit organisations, to maximise your income it's important that you can easily manage your funds and identify donations that are eligible for tax relief.

Sage 50 Accounts provides several reports that help you to analyse your finances by fund, manage gift aid declarations and identify donations which qualify under Gift Aid or the Gift Aid Small Donations Scheme.

This means you have all the information you need, when you need it.

For the funds you select, this shows profit and loss values based on all transactions posted within the date range specified.

For the funds you select, this shows balance sheet values based on all transactions posted within the date range specified.

When you run this report you can choose to run it for one or more nominal codes. For each nominal code it shows individual transactions based on the report criteria you specify and shows the Fund ID for each transaction.

This identifies qualifying donations received but not yet submitted under Gift Aid and the Gift Aid Small Donations Scheme, and provides you with the information you need to complete the Repayment Claims Form R68(i) required by HMRC.

Note: This report is not a substitute for the Repayment Claims Form.

- Select Company > Financial Reports > in the left-hand pane select Charities > from the list of reports select Un-Submitted Gift Aid and Tax Repayment Claims Report > Print, Preview or File as required.

- When prompted, to flag the transactions as included in your Gift Aid and tax repayment claims form and exclude them from this report in future > Yes.

The transactions are flagged as submitted and don't appear on this report again.

This is a gift aid declaration form which you can send to donors. Once you receive the completed form from the donor, donations can be treated as gift aid and tax on the donations can be reclaimed.

Tip: Why not save postage costs by emailing the letter to donors.

This is the report you must submit to your appropriate reporting body if your accounts are prepared on an accruals basis. For more information about this, please speak to your accountant.

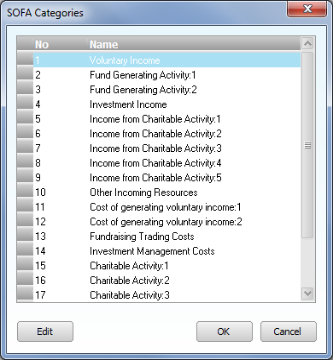

If needed, you can change the headings in this report.

To change SOFA report headings

-

Sage 50 Accounts menu bar > Settings > Nominal Defaults.

-

Select the SOFA category heading > Edit.

- In Name, enter the required SOFA category report title.

- To save and close > OK > OK.

Based on the report criteria you specify, this report lists individual transactions posted to each fund, grouped by nominal account.

- Select Company > Financial Reports > in the left-hand pane select Charities > from the list of reports select Fund Analysis Report > Print.

This lists which nominal codes are in each SOFA category. This information comes from Company > Nominal Ledger > Nominal Record.

- Select Company > Financial Reports > in the left-hand pane select Charities > from the list of reports select Fund Analysis Report > Print.

For more information

The Charity Commission for England and Wales

Office of the Scottish Charity Regulator (OSCR)

The Charity Commission for Northern Ireland

Revenue - Irish Tax and Customs

|

To review Ask Sage, Business Advice and Health and Safety advice, go here. All contact details for Sage are available from here.

|

Go to top

|